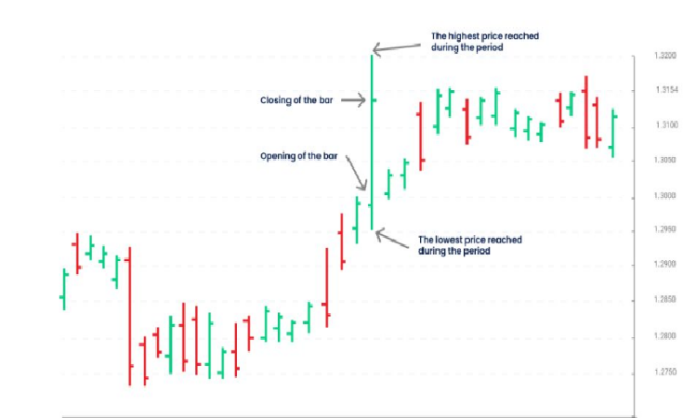

In forex trading, “lower low” and “lower high” are terms used to describe specific price patterns on a price chart. They are often associated with a downtrend, where the overall direction of the currency pair’s price is moving lower. Understanding these terms is essential for technical analysis and making trading decisions. Let’s break down what they mean:

Lower Low (LL): A lower low occurs when the lowest price of a currency pair during a specific time period (e.g., a day, week, or month) is lower than the lowest price reached during the previous time period. It signifies that the sellers in the market have been able to push the price to a lower level, indicating potential bearish momentum.

Lower High (LH): A lower high happens when the highest price of a currency pair during a specific time period is lower than the highest price reached during the previous time period. This indicates that the buyers in the market are unable to push the price as high as before, suggesting weakening bullish momentum.

When you see a series of “lower low” and “lower high” on a price chart, it is often a sign of a downtrend. This pattern suggests that the market sentiment is bearish, and traders may consider looking for selling opportunities or avoiding long (buy) positions. Traders often use various technical indicators and analysis tools to confirm and refine their trading decisions based on these patterns.

It’s important to note that trading solely based on lower lows and lower highs can be risky. It’s recommended to use other technical analysis tools, such as trendlines, support and resistance levels, moving averages, and oscillators, to complement your analysis and make more informed trading decisions. Additionally, fundamental analysis and risk management are crucial aspects of successful forex trading, so traders should consider all relevant factors before executing trades.

Click to sign up with Blackbull

Related Articles:

Types of Forex Charts And How to Learn