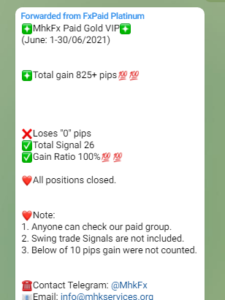

We provide our Performance report frequently. You may visit our Telegram Free Channel for details. For the month of June’2021 our gain ratio 100% but we fail to achieve our target pips. Half yearly and yearly basis performance we gain 90% above all time. Also we make pips as per our target.

If you have any question feel free to contact with us via Live chat or whatsapp.

The performance of trading signals can vary significantly depending on a wide range of factors, including the strategy used, the asset being traded, market conditions, risk management, and the trader’s execution. It’s important to note that trading signals can come from various sources, such as technical analysis, fundamental analysis, or quantitative models. Here are some key points to consider regarding the performance of trading signals:

Strategy Type: The type of trading strategy being employed can have a significant impact on performance. Common strategies include trend-following, mean reversion, momentum, and arbitrage, among others.

Backtesting: Traders often backtest their strategies using historical data to assess how the signals would have performed in the past. However, past performance does not guarantee future results.

Risk Management: Effective risk management is crucial to trading success. Traders should determine their risk tolerance, set stop-loss orders, and manage position sizing to avoid significant losses.

Market Conditions: Market conditions can change over time, and a trading signal that worked well in one environment may not perform as well in another. Volatility, liquidity, and other market factors can impact trading outcomes.

Trade Execution: The timing of trade execution and the price at which orders are filled can influence performance. Slippage and order execution costs can affect overall profitability.

Asset Class: Different asset classes (e.g., stocks, forex, commodities, cryptocurrencies) may require unique strategies and have their own risk profiles.

Signal Provider: The source of the trading signal matters. Signals from reputable sources may have a better track record, but due diligence is necessary when choosing signal providers or systems.

Continuous Monitoring: Active monitoring and adjustments to the trading strategy may be necessary to adapt to changing market conditions and to improve overall performance.

Performance Metrics: Traders often use metrics like win rate, risk-reward ratio, and profit factor to assess the performance of their trading signals.

Psychological Factors: Emotional discipline is critical in trading. Emotional decisions can lead to impulsive actions that undermine the performance of even the most robust trading signals.

It’s important to remember that trading involves a significant degree of risk, and there are no guarantees of success. Many traders experience losses, and it’s possible to lose more than the initial investment. It’s advisable to develop a solid trading plan, thoroughly test strategies, and consider seeking advice or training from experienced traders before engaging in live trading.

If you have specific trading signals or strategies in mind that you’d like to discuss or analyze, please provide more details, and I can offer more specific insights.

- Join in our Telegram: Free Channel