Gold trading strategies are essential tools for investors seeking to navigate the intricate world of precious metals. These strategies encompass a wide range of approaches tailored to different market conditions and individual preferences. One common strategy (how to trade gold) is trend following, where traders analyze historical price data to identify and capitalize on upward or downward trends. Another approach is value investing, which involves assessing fundamental factors like inflation, interest rates, and economic stability to determine the intrinsic value of gold.

Additionally, day trading and swing trading strategies are employed by those who seek to profit from short-term price fluctuations. Gold can also serve as a safe-haven asset, making it a popular choice during times of economic uncertainty or geopolitical turmoil. Moreover, portfolio diversification strategies often include a gold allocation to mitigate risk. Regardless of the approach chosen, success in gold trading requires a combination of thorough research, risk management, and a keen understanding of the market dynamics.

Gold (XAUUSD) has been one of the most liquid assets for centuries now. In the early 1980s to 2000s, even when the interest in the Gold market was not high, it still consolidated about $300 to $500 per ounce. With time, Gold’s interest grew slowly but steadily, year after year. Finally, it imploded during the Financial Crisis of 2007-2008 then rose to an all-time high of over $1900/ounce in 2011.

Since then, the price of Gold has seen a constant surge and has continuously yielded profits to traders and investors. Thus, making it a safe haven asset. In fact, 90% of the world’s total Gold is used to either make jewellery or is held for investment purposes by traders.

Trading Gold has progressed to the point where you no longer need to own or hold the underlying metal physically. Instead, you can make a profit through the rising and falling prices of Gold. This is possible through the use of CFDs or Contract for Differences.

In a falling XAU/USD market, you can go short to make a profit. On the other hand, you can purchase more assets in a rising market to make profits later as the price continues to rise.

There are endless trading opportunities when it comes to Gold. Let’s take a look at the top Gold trading strategies and tips below:

Top Gold trading strategies

Moving average crossover for a short-term trading strategy

A classic strategy for short-term traders is the moving average crossover which helps you profit from the frequent price changes of Gold.

A moving average (MA) is a technical indicator that depicts the smoothening in price trends by filtering out random price fluctuations in a certain period. A moving average crossover takes place when a fast-moving average line crosses a slower one.

When a short-term moving average line crosses over a long-term moving average, it indicates that the market is witnessing an upward trend. Traders take this as a sign to go long on Gold. In case the opposite happens, traders short Gold instead.

It is best suited to figure out moving average crossovers in a 1-hour chart if you are a short-term trader. This is because it allows you to successfully trade the middle of the trend, which in turn, cancels out any noise in the chart.

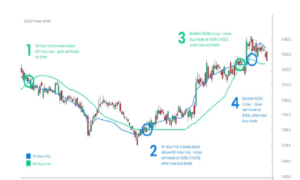

Let’s discuss it with an example:

Point 1 where the short-term 10-hour MA crosses the long-term 60-hour MA. This suggests that a bearish market is forming. The MAs cross again at Point 2 a couple of days later when Gold goes down to around $1,200 per ounce.

At Point 2, the initial Gold trade is closed for a huge gain. In this situation, you could buy Gold as the trend shifts to the upper end of the chart again. Once the price consolidates, Gold rallies up to around $1,300 per ounce. The trade is closed again when you sell the Gold in a bearish MA at this point.

It should be noted that no strategy comes with a full-proof plan of mitigating risks and losses. It can make you lose money as well. In this case, the spike near Point 4 could push some traders to sell at Point 3, resulting in a missed opportunity for a bigger profit.

Real interest rates for a long-term strategy

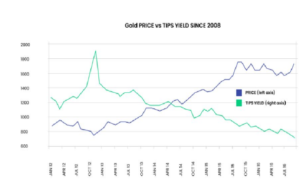

If you are a long-term trader, this strategy perfectly suits your trading decisions. The level of real interest rates in Gold trading drives its prices in the long term.

As the rate of Gold returns rise, so do its interest rates. This move eventually results in a bullish market, bringing higher profits for long-term Gold investors and traders.

You can consider buying more Gold if the yields are below 1%, as that has always been a supportive Gold price. A lower than 1% yield depicts that the earnings generated are not that high and there is still scope for it to increase in the future.

However, if the real yields go beyond 2%, selling might be a wise move. This is because the return on Gold investment does not generally go beyond 2% in the short-medium term and it tends to decrease after the 2% level.

Fibonacci Retracements

Fibonacci retracements are a technical indicator created by taking extreme price points on a chart with one point at a peak and one at the trough. It is then divided by the vertical distance of Fibonacci ratios such as 23.6%, 38.2%, 50%, 61.8%, and 100%.

Traders who enter XAU/USD use it as it shows the points where you can place an entry order or a stop-loss order for your trade. It can also help you set price targets for Gold when you expect the market to be bullish.

The Fibonacci retracement tool can be used in confluence with seasonal patterns of Gold prices to confirm trend patterns. This means that if the market saw an increase in the past, you can wait for it to retrace back to 61.8% to make a successful trade. 61.8% is considered as the ideal turning point level because the price only moves upwards from that point, allowing you to have better long opportunities.

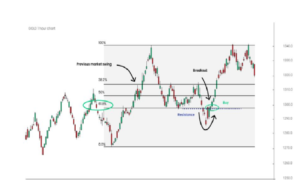

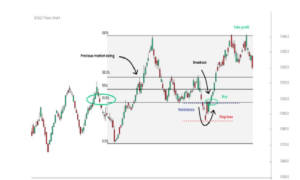

Buying the support level

The support level is the level at which the price stops falling and rallies back up instead. This works as a powerful trading strategy as it gives you the buy and sell points of any asset, including Gold. Buying Gold at the support level means that the prices will only increase after this point.

Placing stop-losses below the previous low swing

When trading XAU/USD with a stop-loss strategy, you can place the order below the last low. This way, you can mitigate potential losses should the market decides to dip lower. Further, you only lose the amount you can afford to lose and protect yourself against hefty risks and losses.

Top Gold trading tips for beginners

Here are the top 8 tips for you to make informed and better decisions as you start your Gold trading journey:

Focus on small trades

Since you are fairly new to trading XAUUSD (how to trade gold), it is best to keep the size of your trades small. You should focus on trades that could give you decent profit and protect yourself from big losses. However, if you are aiming for a long-term investment, you can choose to extend the position size.

Pay attention to Gold charts

Gold price charts witness cycles and turning points that tell you a lot about the current Gold market. When a market is cyclical in nature, cycles are a great help for both short and long-term trades. It also helps in understanding the future position of the market, which can affect your buy and sell decisions altogether.

Combine the strategies together

As we have discussed the major Gold trading strategies above, it is best to use them in confluence. When you combine a few strategies together and put them to use accordingly, they give you better and more accurate results. A strategy on its own is not enough for you to survive in the market in the long run.

Use trendlines

Trendlines are useful tools to predict the price movement in the future by connecting price points. The two types of trendlines are an upward and a downtrend. Trendlines are often used to predict patterns as they extend in the long run and serve as support for an uptrend or resistance for a downtrend.

Use previous highs and lows as support and resistance levels

The support level (Gold Trading Strategies) is the point at which the price stops falling and start rising. On the other hand, the resistance level is the point at which the price stops rising and dips instead. The strength of either the resistance level or the support level is also the strength of the same levels created as an increasing or decreasing trendline. The more significant the low or high is, the stronger the support or resistance level is.

Pay attention to the volumes

Paying attention to trade volumes is extremely important especially in the XAU/USD market. If a rally is followed by a rising volume of Gold, it is likely to extend the rally even more.

Alternatively, a decline accompanied by a rising volume suggests (how to trade gold) that the decline will continue. However, when a lower volume accompanies the decline, the implications stand invalid and should not be taken into consideration while making trading decisions.

Don’t make hasty decisions

It is best advised to wait for market breakdown confirmations (how to trade gold) before you take any actions. When the closing price is below or above the critical price level before the breakdown happens, the breakdown is confirmed. When a breakout is invalidated, it means that the market is still bearish. Meanwhile, when a breakdown is invalidated, the market is bullish.

Analyse other markets

The world economy is highly interlinked. With globalisation and transportation becoming seamless over the years, no market is independent. Gold and other precious metal industries (how to trade gold) move hand in hand. Their price movements are mostly linked to movements in the stock market, Forex market, and more. Hence, it is important that you check other markets that may influence the Gold market before making any huge decisions.

An example is if Gold prices move (Gold Trading Strategies) in the exact opposite to the US Dollar Index (USDX) while you consider opening a long position. If you see the USDX close on a resistance level, being overbought, it is most likely that the currency will trigger a dip. In such a situation, you should sell your Gold as soon as possible to avoid any losses.

Start trading Gold today

The XAUUSD market (Gold Trading Strategies) is one of the most popular markets for traders and investors alike. It is widely considered a safe investment asset in the long run and it can also help you profit through short-term trades.

Click to Open a New Trading Account

Related Post:

Gold trading analysis on dated 30-5-2023